All Categories

Featured

Table of Contents

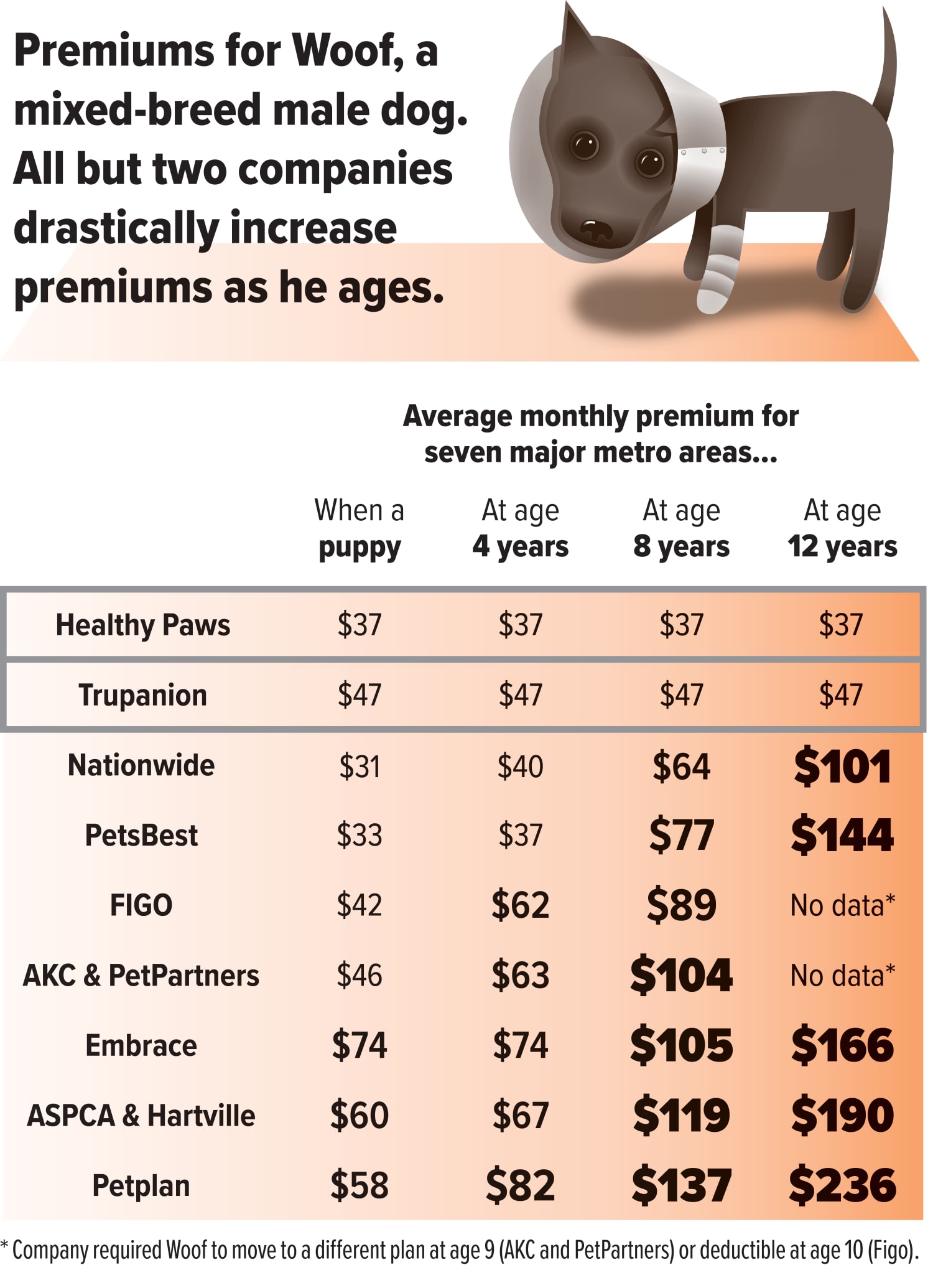

Similar to in human medicine, you can keep your costs reduced by choosing a high insurance deductible, a reduced repayment price or a reduced, insurance coverage limit. Because the firm Vet Animal Insurance policy (VPI) was formed in California by a team ofveterinarians in the late 1970s several firms have actually come and gone. VPI was bought byNationwide several years back and is still among the leaders in the industry yet there are numerous credible companies in the marketplace currently.

As veterinary medication comes to be much more highly progressed, the expense of care rises. That's as a result of higher expenses associated with the equipment, facilities and training needed to supply these higher-quality solutions (pet insurance). Pet dog wellness insurance policy can assist by countering some or a lot of the costs of diagnosing, dealing with and managing your pet dog's disease or injury

All charges, including co-pays, deductibles, add-on costs and other costs, need to be plainly explained to you so you fully recognize the plan and its constraints. You must be permitted to select the veterinarian that will certainly take care of your family pet. Pet insurance strategies are usually repayment strategies you foot the bill in advance and are repaid by the insurance provider.

The Best Strategy To Use For The Differences Between Pet Healthcare Plans & Insurance - Medivet

If you're worried about covering the costs up front, ask your veterinarian regarding payment options that will benefit you in instance you require to make plans. It's ideal to understand your choices in advance so you do not have actually the included anxiety of trying to make repayment plans during an emergency.

There are customer web sites that compare functions and costs of pet dog insurance, and/or offer testimonials, and you might locate these practical. The AVMA does not recommend or suggest any type of provider over others.

The protection one kind of plan deals might differ from one animal insurance company to the following, so pay very close attention to the details when purchasing a pet insurance coverage. As the name suggests, these policies only cover (qualified) injuries or clinical problems that are unexpected. For example, an accident-only plan will not cover optional surgical treatment to remove a lump, yet it should cover vet costs for things like damaged bones or lacerations.

How Is Pet Insurance Worth It? - Petmd can Save You Time, Stress, and Money.

If your goofball young puppy swallows an international object or something poisonous, your insurance provider will likely foot the resulting veterinarian bill. If you're on a budget plan, an accident-only strategy may be an excellent alternative for you and your pets.

Right here's a take a look at the kind of conditions these family pet insurance coverage policies do and don't cover. pet insurance. Caret Down Icon Burns Bite injuries Bloat Broken nails Broken bones Eye injury Contaminant or object consumption Broken teeth Intoxication Lacerations Poisoning Torn cruciate ligaments Caret Down Symbol Diseases (microbial or viral) Routine vet visits A crash and disease strategy provides one of the most thorough family pet insurance, covering both injuries and diseases

Think about a copayment as an "gain access to" charge that you pay to obtain your reimbursement.: This is the amount you require to pay of pocket prior to your coverage kicks in. The higher the insurance deductible, the reduced your month-to-month premium, it's everything about balancing what jobs for your budget.

Table of Contents

Latest Posts

The Best Strategy To Use For Pet Friendly Furniture & Flooring - Nfm

Some Known Details About Sleeping In Style: A Guide To Choosing The Perfect Dog Bed - Rogz

Our Do You Need Pet Insurance? - American Veterinary Medical ... Ideas

More

Latest Posts

The Best Strategy To Use For Pet Friendly Furniture & Flooring - Nfm

Some Known Details About Sleeping In Style: A Guide To Choosing The Perfect Dog Bed - Rogz

Our Do You Need Pet Insurance? - American Veterinary Medical ... Ideas